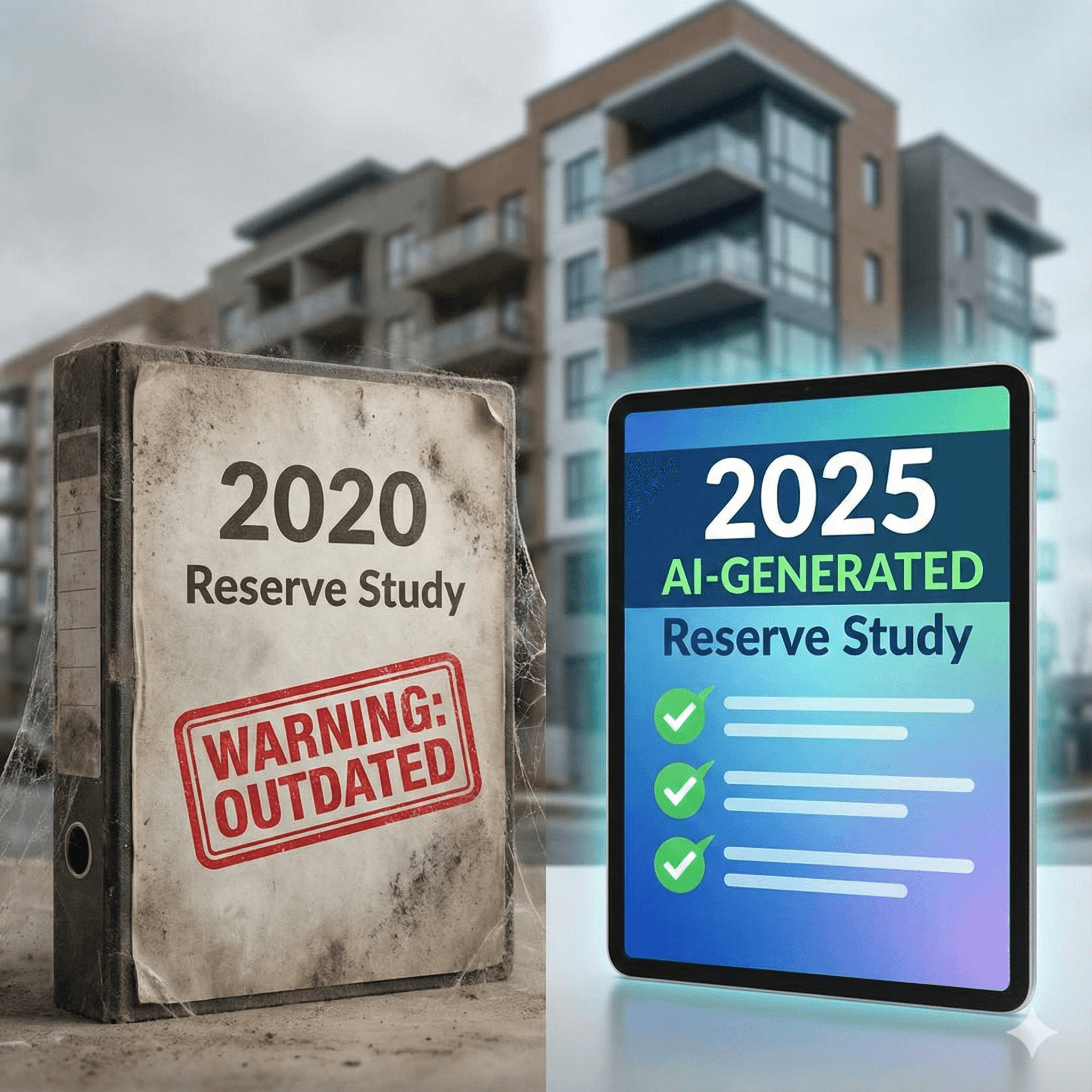

If you are an HOA board member looking at a reserve study dated 2020, 2019, or earlier, you are effectively navigating a ship using a map from a different era.

The world has changed dramatically since then. The cost of asphalt has risen. The price of roofing labor has skyrocketed. Insurance premiums have doubled in some states. A reserve study that claimed you were "80% funded" in 2019 might mean you are barely 40% funded today, simply because the replacement costs in that PDF no longer exist in the real world.

For many boards, the realization hits hard during budget season: “We aren’t saving enough.”

The knee-jerk reaction is to call a reserve specialist, only to be told there is a 12-week waitlist and a $5,000 fee for a site visit. But you don't always need a full "Level 1" site inspection to fix your numbers. Here is why your study is outdated and how to update it fast.

1. Why Your 2020 Study is "Math Fiction"

Reserve studies are snapshots in time. They rely on assumptions about inflation and interest rates.

Most studies written before 2021 assumed a steady historic inflation rate of roughly 2.5% to 3%.

Reality had other plans.

Construction Inflation: In 2021 and 2022, the cost of construction materials spiked by over 20% in some categories.1

Labor Shortages: The cost to hire contractors for major capital projects (siding, paving, painting) has outpaced general consumer inflation.

If your 2020 study estimated that replacing the clubhouse roof in 2025 would cost $50,000, the actual bid today might be $85,000. If your savings plan was based on the $50k number, you are instantly $35k short. Multiply that across every asset in your community, and the deficit becomes massive.

2. The Risks of "Wait and See"

Ignoring an outdated study is not a passive choice; it is an active risk.

The "Special Assessment" Bomb: When the roof actually fails and you don't have the cash, your only option is a Special Assessment. Demanding $5,000 per door from homeowners on short notice is the fastest way to destroy community morale and get the board voted out.

Lending Blacklists: Fannie Mae and Freddie Mac have tightened their lending guidelines.2 If your HOA cannot prove it has adequate reserves (often defined as 10% of the budget contribution or a funded status check), prospective buyers may be denied mortgages. Your property values will tank if buyers can't get loans.

Personal Liability: In many states, board members have a fiduciary duty to maintain the property. Willful ignorance of financial reality can, in extreme cases, expose the board to liability.

3. The Fix: Full Update vs. Automated Update

You know you need new numbers. But do you need a full site inspection?

Option A: The Full "Level 1" Study (Slow & Expensive)

This is where a credentialed engineer visits your property, measures the pool deck, climbs on the roof, and counts the lights.

Best for: New associations, or properties that haven't had a study in 5+ years or have added new amenities.

Cost: $4,000 - $8,000.

Timeline: 8 - 12 weeks.

Option B: The AI-Powered "Level 3" Update (Fast & Efficient)

A "Level 3" update (Update without Site Visit) assumes the inventory is correct (you still have one pool and three roads) but the financials are wrong.

Modern AI-driven reserve software can ingest your old 2020 study, digitize the asset list, and then apply real-time 2025 pricing data to every component.3

Best for: Associations with a decent prior study that just need to fix the inflation/cost numbers.

Cost: Often under $1,000 (or included in monthly software subscriptions).

Timeline: 24 - 48 hours.

4. How the "Fast Update" Works

If you choose the modern, automated route to get your numbers straight before the annual meeting, the process is simple:

Digitization: You upload your old PDF study. Optical Character Recognition (AI) pulls out the data: 5,000 sq ft of asphalt, installed 2015, life expectancy 20 years.

Local Cost Adjustment: The software checks current market rates for your specific zip code. It sees that asphalt in your area is now $3.50/sq ft, not the $2.50 listed in your old study.

Life Re-Calculation: It recalculates the funding path. It might tell you: "To afford this asphalt in 2035 at the new prices, you need to raise dues by $12/month starting now."

Board Review: You get a dashboard, not a static PDF. You can adjust the assumptions ("We actually patched the road last year, let's extend the life by 2 years") and see the funding percent update instantly.

Summary: Stop Guessing

If your board is debating the budget based on 2020 estimates, you are planning for a world that no longer exists.

You do not need to wait three months for a consultant to tell you that prices have gone up. Using automated reserve study tools, you can update your financial roadmap this week. It is the responsible way to protect your homeowners from the shock of a Special Assessment.

Ankit is the brains behind bold business roadmaps. He loves turning “half-baked” ideas into fully baked success stories (preferably with extra sprinkles). When he’s not sketching growth plans, you’ll find him trying out quirky coffee shops or quoting lines from 90s sitcoms.

Ankit Dhiman

Head of Strategy

Subscribe to our newsletter

Sign up to get the most recent blog articles in your email every week.